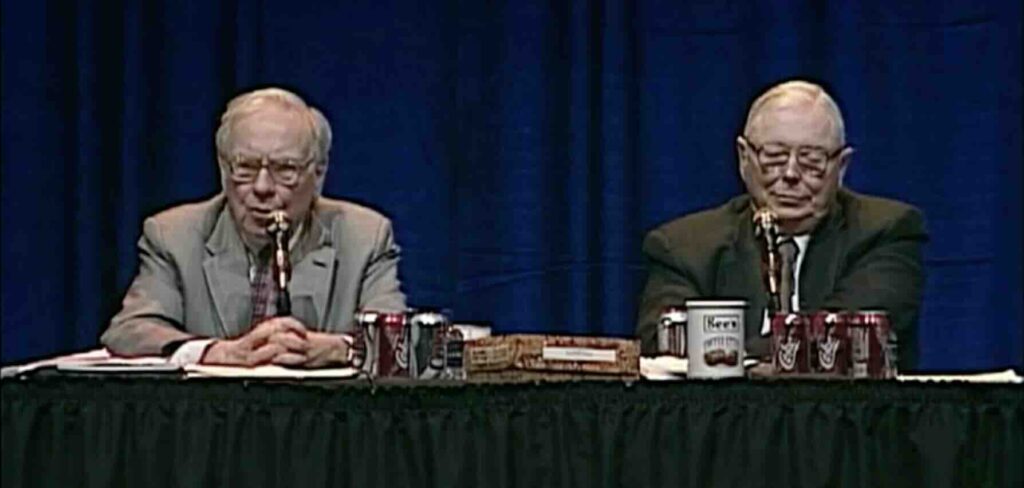

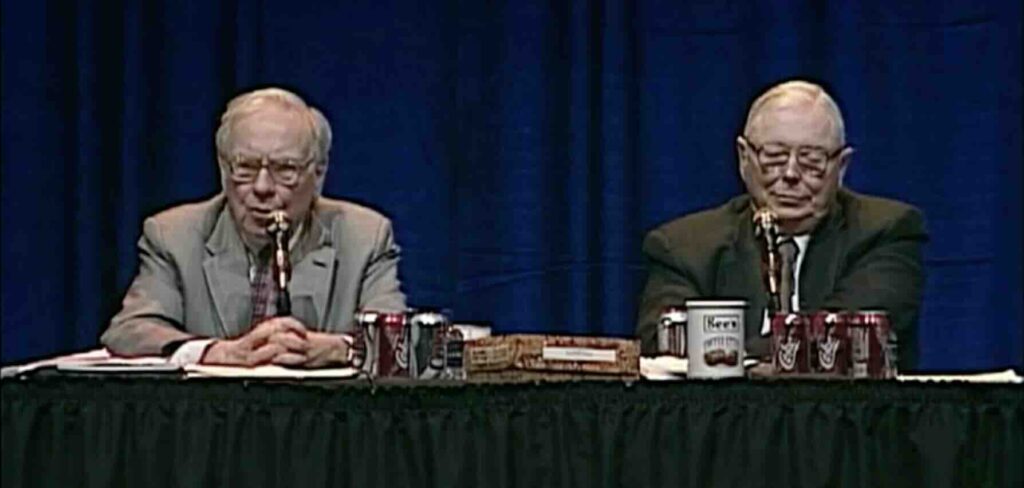

2005 Berkshire Hathaway Annual Meeting

- Buy Inflation-Resistant Businesses

- Seek companies that sustain (or grow) real earnings without needing constant, expensive reinvestment (e.g. See’s Candy).

- Steer clear of capital-heavy industries whose replacement costs balloon in inflationary times (e.g. legacy airlines).

- Don’t Bet Against America

- Over centuries, U.S. per-capita GDP has grown ~7× despite wars, policy missteps, and market panics—trust that trend.

- Focus on finding great businesses at fair prices rather than trying to time macroeconomic cycles.

- Watch for Hidden Legacy Liabilities

- Contracts signed in boom times (pensions, retiree health care) can cripple competitiveness when markets shift.

- Always stress-test a company’s balance sheet for off-balance-sheet or unfunded obligations before investing.

- Align Insurance Incentives Around Underwriting Quality

- Guarantee underwriters won’t lose their jobs when premiums dip, so they never chase bad business to hit volume targets.

- Accept higher expense ratios in soft markets—better than teaching staff to write unprofitable policies.

- Decentralize & Trust Expert Managers

- Acquire owner-operators, then give them autonomy rather than imposing heavy-handed “synergy” mandates.

- Minimal oversight preserves the culture and incentives that made those businesses special in the first place.

- Invest in People First, Assets Second

- Recruiting exceptional talent (e.g. Ajit Jain) can outperform even the best asset plays—people compound value.

- Empower top performers with resources and freedom; their upside often far exceeds any single deal.

- Stay in Your Circle of Competence

- Concentrate on industries and business models you truly understand, not wherever the headlines point.

- Admit what you don’t know—better to sit out or seek advice than chase complex areas beyond your grasp.

- Keep Dry Powder for Opportunistic Buying

- Holding cash (or equivalents) lets you pounce on bargains when markets stumble or irrational fears grip investors.

- Resist the urge to be fully deployed at market highs; patience often yields the best entry points.

- Differentiate Productive Assets from “Stores of Value”

- Gold and similar non-yielding assets lack utility and long-term return power—far better to own real businesses.

- Assess an investment by its ability to generate cash flows, not scarcity or “intrinsic mystique.”

- Pick Businesses, Not Macro Forecasts

Lessons from this meeting:

- Bottom-up fundamental analysis beats guessing where interest rates or the dollar will be in ten years.

- If a company trades far below your estimate of its intrinsic value, act—no need to await “perfect” timing.

Leave a Reply